MEP pension had investments in tax havens, according to EUobserver

May 17, 2023Tweet

Members of the European Parliament (MEPs) paid into a pension scheme which held assets in the Cayman Islands, Bermuda and other countries in which taxes were levied at a low rate, in spite of a European Parliament (EP) crackdown on tax havens. The investments were made during the 2008-2010 financial crisis and during a time when the European Parliament was demanding a crackdown on tax havens and was set to pass a resolution highlighting profiteering from tax avoidance. The voluntary pension fund is currently running at a deficit of more than $410 million and may require a taxpayer bailout as soon as 2024. A Greens-tabled amendment calling for MEPs to withdraw from the fund if they already receive another pension was voted down by 272 to 203, with Lewandowski, Karas and Zile among those who voted to reject the proposal.

Comments

Related news

According to Pentagon leaks, Beijing would quickly seize control of Taiwan's airspace.

Read more

'Accelerated ageing' is a concern for Guantanamo detainees, according to the Red Cross

Read more

Russia almost downed a British spy aircraft, according to WaPo

Read more

More than 20,000 Russian fighters have died in the Ukraine war, according to the US

Read more

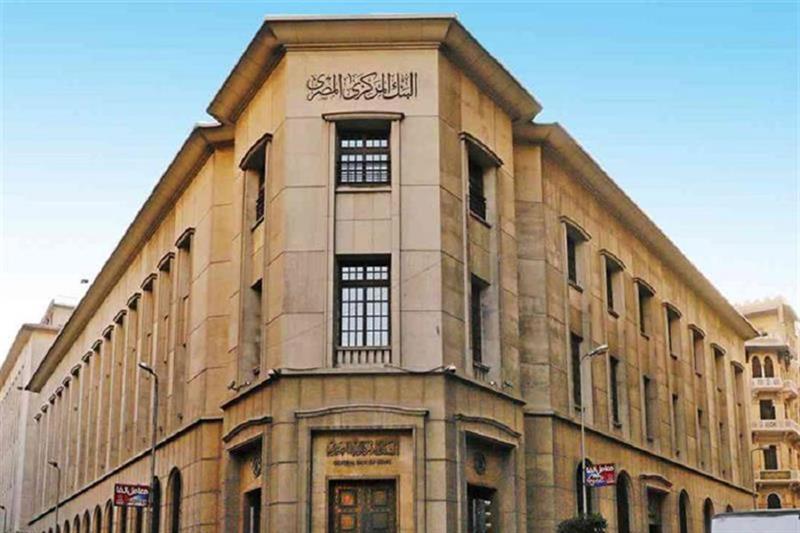

InstaPay transactions were EGP 112.7 billion, according to CBE, in one year.

Read more

Ancient sculptures of "white men" might be demolished in the UK, according to Telegraph

Read more

American values are rapidly deteriorating, according to a survey

Read more

Asia war would "radically" alter the world, according to Singapore

Read more

Macron wants the French pension system in place by the end of the year.

Read more